All employers must automatically enrol certain staff into a pension scheme and make contributions. Employers are also required to let staff know about the scheme and allow staff to join the scheme voluntarily. Although automatic enrolment is an ongoing responsibility, there are a number of things to keep in mind when getting ready for it.

All employers must automatically enrol certain staff into a pension scheme and make contributions. Employers are also required to let staff know about the scheme and allow staff to join the scheme voluntarily. Although automatic enrolment is an ongoing responsibility, there are a number of things to keep in mind when getting ready for it.

In order to get prepared for automatic enrolment, businesses need to find out their staging date. This date appears on a letter that is sent from The Pensions Regulator, which is the regulator for work-based pension schemes. Alternatively, you can also use your PAYE reference and determine the date online. You will also have to nominate a point of contact that will be your businesses point-person to receive guidance and help through email updates. Businesses can provide a point of contact online to The Pensions Regulator.

Getting ready before the staging date is essential, and businesses need to make plans at least a nine months to a year prior to the staging date. The Pensions Regulator has an online planning tool to help your business prepare. The planner provides information on what steps need to be taken and by when in order to prepare for automatic enrolment. While planning ahead will avoid last minute hassles, it is also important to consider the costs of setting up your pension scheme. Costs may include the purchase of software that will be used to manage automatic enrolment as well as any advice you might want to seek from independent advisors.

A regular contribution must also be paid into the pensions by employers. Contributions can be calculated using an online resource available from The Pensions Regulator. Before 30 September 2017, the minimum employer contribution is one per cent (two per cent total minimum contribution). From October 2017, the minimum employer contribution is two percent (five per cent total minimum contribution) and from 1 October 2018, the employer minimum contribution is three per cent (eight per cent total minimum contribution). Employees may pay pension contributions, which are deducted from regular pay and paid into the scheme.

Only certain staff are eligible for automatic enrolment in pension schemes, and it is up to you to assess who is eligible. In order to evaluate who is eligible, make sure your staff and payroll records are up-to-date with dates of birth, National Insurance numbers and contact details before the staging date. Any person aged 16 to 74 have the right to join a pension scheme if they earn £481 and below per month. Any employee earning over £481 up to £833 per month has the right to opt into the scheme. If an employee earns more than £833 per month, they have the right to opt in if they are 16 to 21 years of age or from the state pension age to 74. Employees earning more than £833 per month who are aged from 22 to the state pension age are automatically enrolled.

The next step is choosing a pension scheme. If you already have a scheme for your employees, check with your pension provider to determine if it is appropriate for automatic enrolment. You may need to create a new pension scheme, so it is important to speak to a pension provider six to nine months before your staging date. The National Employment Savings Trust (NEST) is a government pension scheme open to all employers. Other options are also available from a variety of private sector sources.

At your business’ staging date, you will have to identify which employees will be automatically enrolled and which ones have the right to join the pension scheme. After the staging date, you must notify your employees in writing about automatic enrolment. The Pensions Regulator has a number of template letters that can help you. You must also complete a declaration of compliance once staff are automatically enrolled. This form of registration lets The Pensions Regulator know that you have fulfilled all legal responsibilities.

For more information about automatic enrolment, visit www.thepensionsregulator.gov.uk/automatic-enrolment

Prime Office Space has compiled a series of guides to help you with all your Office Requirement needs which include Office Planning, Office Equipment, Communications Equipment, Office Furniture, Computer Equipment and Office Supplies.

Prime Office Space has compiled a series of guides to help you with all your Office Requirement needs which include Office Planning, Office Equipment, Communications Equipment, Office Furniture, Computer Equipment and Office Supplies.

All employers must automatically enrol certain staff into a pension scheme and make contributions. Employers are also required to let staff know about the scheme and allow staff to join the scheme voluntarily. Although automatic enrolment is an ongoing responsibility, there are a number of things to keep in mind when getting ready for it.

All employers must automatically enrol certain staff into a pension scheme and make contributions. Employers are also required to let staff know about the scheme and allow staff to join the scheme voluntarily. Although automatic enrolment is an ongoing responsibility, there are a number of things to keep in mind when getting ready for it.

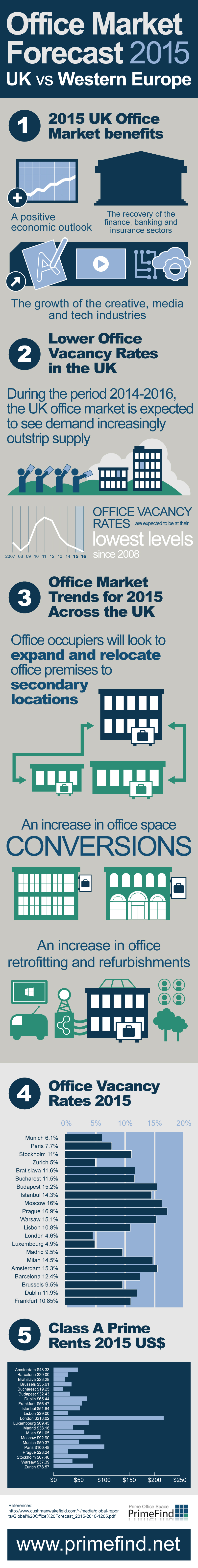

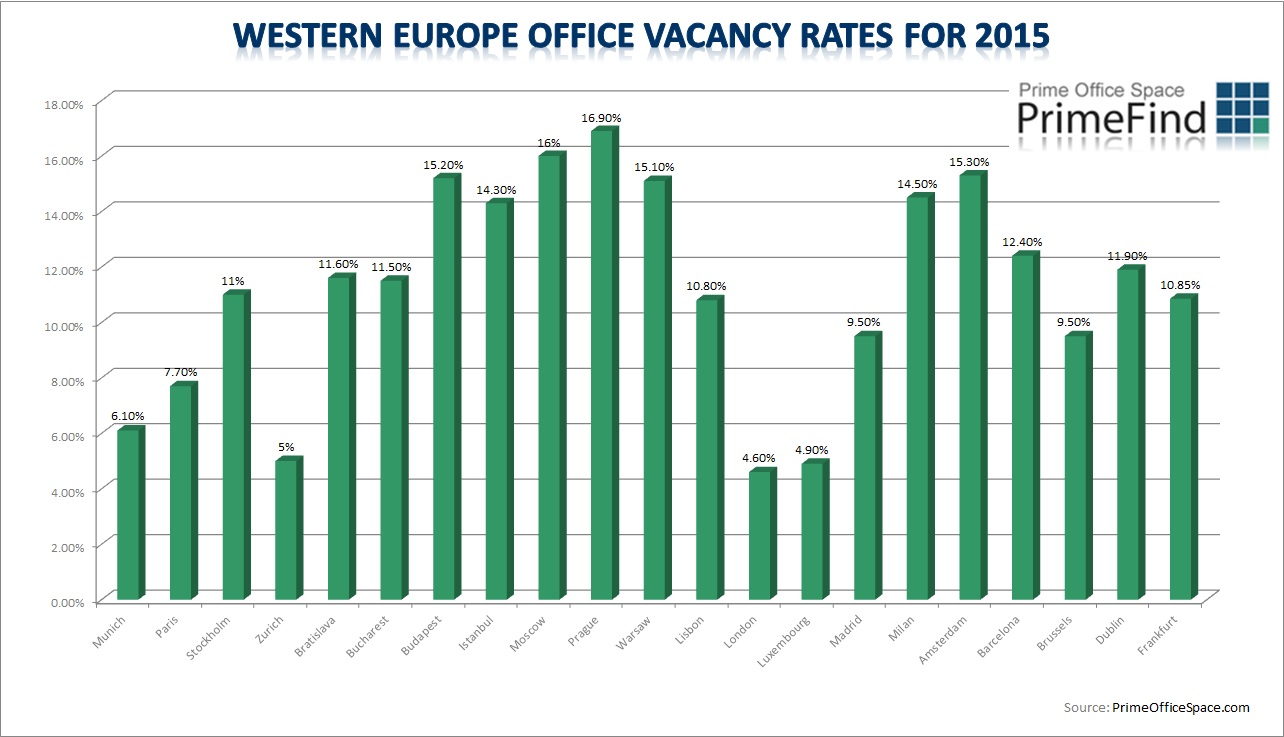

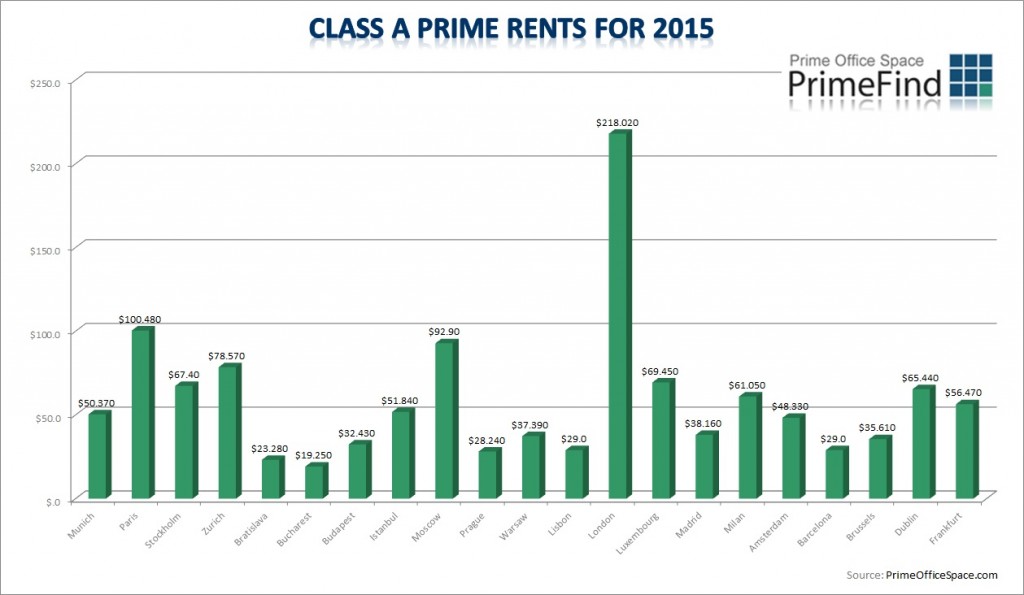

According to market analysts at Cushman & Wakefield, 80 per cent of the European markets studied are set to experience rental growth during the next 12 months. Of the 21 cities that were included in the study,

According to market analysts at Cushman & Wakefield, 80 per cent of the European markets studied are set to experience rental growth during the next 12 months. Of the 21 cities that were included in the study,

Finding the right office space at the right price and in the right area is an important step in doing business. Renting is a flexible way of securing an office space, especially for new businesses. A lease agreement typically lasts for several years, so there are a number of important considerations that need to be taken into account when leasing office space.

Finding the right office space at the right price and in the right area is an important step in doing business. Renting is a flexible way of securing an office space, especially for new businesses. A lease agreement typically lasts for several years, so there are a number of important considerations that need to be taken into account when leasing office space. New VAT regulations come into effect in January 2015. Fast becoming known as the “Digital VAT”, for small to medium enterprise (SME) businesses, the VAT regulations mean changes to the pricing aspects of products you sell through the internet.

New VAT regulations come into effect in January 2015. Fast becoming known as the “Digital VAT”, for small to medium enterprise (SME) businesses, the VAT regulations mean changes to the pricing aspects of products you sell through the internet. The Nine Elms area of Battersea in south-west London will be part of a new regeneration plan. Announced in November 2014, the 57-acre project will be developed by a consortium that includes St Modwen Properties, construction firm Vinci and the Covent Garden Market Authority. At the heart of the regeneration plan will be the refurbishment of New Covent Garden. Set to begin construction in spring 2015, the project will include new housing and office space as well as recreation and leisure facilities.

The Nine Elms area of Battersea in south-west London will be part of a new regeneration plan. Announced in November 2014, the 57-acre project will be developed by a consortium that includes St Modwen Properties, construction firm Vinci and the Covent Garden Market Authority. At the heart of the regeneration plan will be the refurbishment of New Covent Garden. Set to begin construction in spring 2015, the project will include new housing and office space as well as recreation and leisure facilities. Being one of the UK’s most dynamic and forward-looking areas, Scotland has been increasingly profiling itself as a prosperous business and investment location. The area’s potential has been thoroughly explored by the Scottish Executive, who drafted the ambitious Scotland’s Regeneration Plan in December 2011. So what exactly are the objectives of this master plan for Scotland and how will it impact those who live and work in the area? Take a look at our detailed overview of Scotland’s Regeneration Plan and of its scope.

Being one of the UK’s most dynamic and forward-looking areas, Scotland has been increasingly profiling itself as a prosperous business and investment location. The area’s potential has been thoroughly explored by the Scottish Executive, who drafted the ambitious Scotland’s Regeneration Plan in December 2011. So what exactly are the objectives of this master plan for Scotland and how will it impact those who live and work in the area? Take a look at our detailed overview of Scotland’s Regeneration Plan and of its scope. Approved in

Approved in