As we leave 2013 behind and we enter a new year, it is time to take stock of the latest developments that have taken place in the real estate industry throughout the United Kingdom. More importantly, this is the ideal time of the year to explore the experts’ predictions on what 2014 will bring to the British real estate sector. Take a look at our summary of the key findings and predictions.

Continued growth

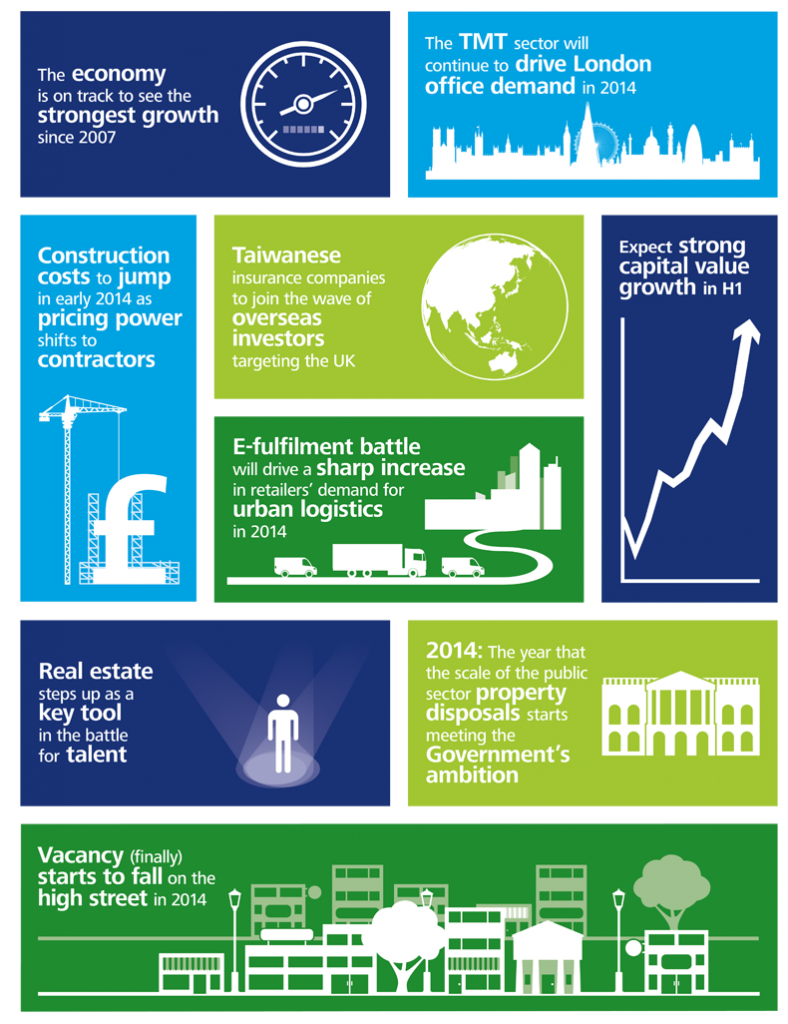

Last year, the real estate market showed signs of recovery, especially during the second half of 2013. In fact, and according to chief economists at Deloitte, the UK economy is set to grow at its highest level since the onset of the recession in 2007, with predicted growth rates of 2.5 per cent according to the latest estimates.

The overall positive economic outlook will undoubtedly affect the real estate industry across all sectors. A recent report published by The Guardian suggests that average residential property prices could rise by up to 8 per cent by the end of the year. Even the most pessimistic predictions point at average price increases of 5 per cent.

The Royal Institution of Chartered Surveyors has also predicted that 2014 will see a gradual closure in the gap between the London property market and other regional markets. The latest predictions affirm that while asking prices in London could go up by 11 per cent, other parts of the country will also experience significant price hikes, reaching 10 per cent in the East Midlands and the South East of England.

The role of Asian investors

2013 saw a substantial increase in the number of foreign investors who were attracted to the British real estate market. Last year, nearly 42 per cent of all transactions were carried out by overseas investors, and trend seems to be here to stay during 2014. The flow of overseas capital poured more than £20 billion in the commercial sub-sector alone, and market analysts remain optimistic about the possibility of an even greater amount of investment this year.

The role of Chinese and Taiwanese investors is thought to be particularly influential during the remainder of this year. The latter (who since mid-2013 are free to invest in foreign markets) are increasingly looking at UK assets, especially in the British capital. Taiwanese investors are aiming high and seem to prefer large-scale transactions, as exemplified by the £260 million deal they recently closed with the purchase of the Lloyd’s building in central London.

Big expectations from the TMT sector

All analysts agree that the technology, media, and telecommunications sector has been one of the main drivers of leasing activity during the past year. Approximately 70 per cent of all the pre-let deals that took place in London last year were carried out by firms in this fast-growing sector, which currently employs 10 per cent of the London workforce and occupies 25 million square feet of office floor space in the capital.

Experts at Deloitte predict that starting in 2014, the role that the TMT sector plays in the real estate industry will continue to increase, bringing about sustained demand, high take-up rates, and a high volume of transactions, especially in areas like London’s Tech City. It is also worth noting (as well as encouraging) that this seems to be a global trend, as the real estate market in other high-profile cities like Paris, Munich, and New York is experiencing similar trends.

The comeback of the commercial sector

Market analysts also forecast a surge in activity in the commercial sector, which was particularly affected by the economic recession. Most likely, this change will be brought about by vastly improved logistics and delivery operations and by a revival in footfall across the country’s high streets. As consumer confidence grows, it is reasonable to expect that retailers may consider moving into new and larger premises, bringing more revenue into the commercial property market, as well as a decrease in vacancy rates of empty commercial units at national scale.

However, one must note that the experts prefer to remain cautious as to the exact growth levels that we can expect from this market sub-sector. This is mostly due to low wage growth levels and to the unparalleled rise in the number of retail transactions carried out online.

The public sector

Following a series of governmental incentives, it seems that 2014 will finally meet the expectations of policy makers in terms of their public sector property disposal targets. Changes have already begun to occur, as some public sector offices have been downsized, therefore releasing much-needed space into the market. There is also a possibility that some public sector property could be released and transformed into housing units in order to address the housing shortages experienced by certain communities.