If there is one thing that can be said about the UK’s commercial property market, it is that this sector is finally showing solid signs of recovery. Overall, 2014 was a good year for this sector, which has experienced significant growth in activity levels in pretty much every market sub-sector. In particular, the UK’s office property market has established itself as a global leader following a period marked by contraction after the financial crisis. But is this positive trend here to stay? And what can we expect from the British commercial property market during 2015?

In November 2014, real estate firm Cushman & Wakefield published a comprehensive report that examined the main trends that are expected to affect the UK commercial property market during 2015. The report also provided a wealth of information on the major global markets. In this post we have put together the highlights of this interesting report and we provide an overview of the main trends to watch out for in 2015, with a special focus on the office market.

The UK’s office market: Key trends for 2015

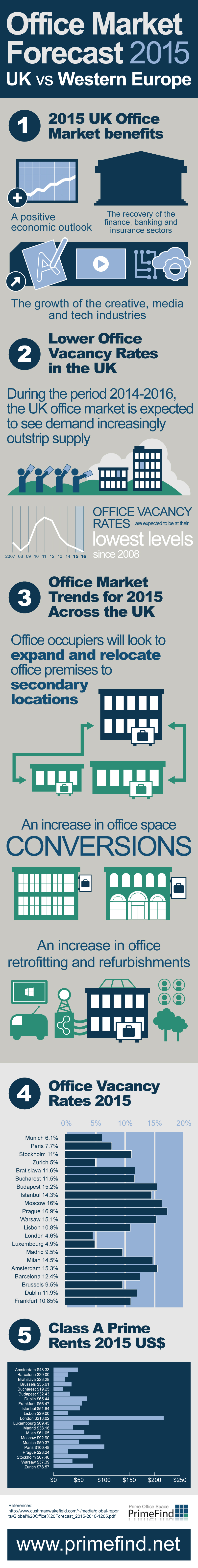

According to market analysts at Cushman & Wakefield, 80 per cent of the European markets studied are set to experience rental growth during the next 12 months. Of the 21 cities that were included in the study, London tops the list of best-performing office markets in Western Europe. According to the report, the office market in the British capital will benefit from a positive economic outlook, which is very likely to boost occupier demand. In addition, and in line with the trends that we have seen during 2014, the growth of the creative, media, and tech sectors will continue its upward trend, bringing about increased demand for Grade A space in prime rental locations in the West End and beyond. The recovery of the finance, banking, and insurance sectors is also expected to consolidate over the next 12 months, and this is likely to bring renovated interest in office properties throughout the City.

Another important thing to note about the UK’s office market is its limited development pipeline. The number of completions is set to remain below the decade’s average until 2016. This fact, (coupled with an increased preference for pre-lease agreements from the occupiers’ side) will result in diminished availability of prime office floor space over the next two years. In the short term, this trend is likely to cause rental growth values to increase.

Overall, researchers at Cushman & Wakefield affirm that during the period 2014-2016, the UK office market is expected to see how demand increasingly outstrips supply. This fact will most probably bring vacancy rates to their lowest levels since 2008, particularly as office occupiers look to expand and to relocate into office premises at secondary locations. But a renovated interest in secondary locations is not the only trend that will characterise the British office market during 2015. According to the report published by Cushman & Wakefield, office space conversions, retrofitting, and refurbishments are also set to increase exponentially next year across most UK regions.

The UK’s office market in perspective: Global comparisons

In this global era, no property market exists in isolation from the rest. The performance and forecasts that apply to global markets are a useful indicator for the UK’s office market and can help investors and occupiers make the right decisions. Below you will find a selection of the most notable global trends affecting office properties all over the world.

First, it is important to note that GDP growth across Western Europe has been predicted at 1.7 per cent. The best performing economies are the UK, Poland, Hungary, and Romania, and it is precisely in these markets where we can expect to see the highest office inventory absorption rates, ranging from 13 per cent in Warsaw to 18 per cent in Bucharest. In terms of new office developments, Istanbul, Bucharest, Prague, Warsaw, and Moscow are on the lead, whereas London, Lisbon, Madrid, and Barcelona are set to be the worst-performing in terms of their respective development pipelines. In Europe, office space is at its dearest in London, where prime rents are expected to average £127.5 sq/ft/year, increasing to £130 sq/ft in 2016. Dublin, Paris, Zurich, and Brussels are other European markets where office rental values are set to grow.

Across the Atlantic, the office markets in Boston, Chicago, and Atlanta are expected to be subject to growing demand, while rental growth in New York will continue to rise steadily until 2016. Investors are advised to keep an eye on the most promising emerging markets, like Mexico City and Santiago de Chile. In the Asia-Pacific region, the most encouraging forecasts relate to the office markets in Singapore, Manila, and Bangkok, where vacancy rates will continue to decline and rental growth will continue to increase. Other markets that are expected to perform well in this region include Sydney, Beijing, Shenzhen, Tokyo, and New Delhi.

Source:

http://www.cushmanwakefield.com/~/media/global-reports/Global%20Office%20Forecast_2015-2016-1205.pdf