Barnsley was once an industrial town with thriving coal mining and glassmaking industries. The South Yorkshire town is now at the centre of regeneration efforts. In 2002, Barnsley Metropolitan Borough Council launched a regeneration programme designed to revitalise the town centre with an improved transport interchange, a new digital media centre, along with new offices and apartments. With its strategic location along the M1 corridor, the town’s business parks have also spurred job growth.

Barnsley was once an industrial town with thriving coal mining and glassmaking industries. The South Yorkshire town is now at the centre of regeneration efforts. In 2002, Barnsley Metropolitan Borough Council launched a regeneration programme designed to revitalise the town centre with an improved transport interchange, a new digital media centre, along with new offices and apartments. With its strategic location along the M1 corridor, the town’s business parks have also spurred job growth.

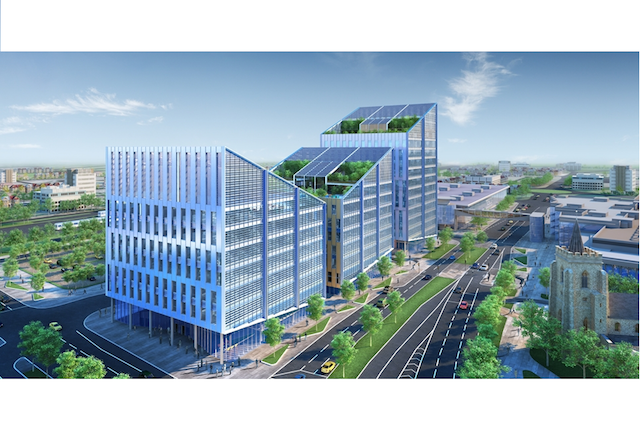

In an effort to further develop the local economy, the Barnsley Town Centre Regeneration Project will add approximately 35,000 square metres of new retail and leisure space. This will include new shops, restaurants and cafes as well as a family entertainment centre and cinema. Led by the Barnsley Council, the project involves £50 million in government funding and significant investment opportunities. The project’s Gross Development Value (GDV) is estimated at £100 million and it will help create an estimated 300 temporary and 700 permanent jobs according to the UK government’s Regeneration Investment Organisation (RIO).

The project continues previous investments in the town centre, including the £8.2-million digital media centre. The centre offers incubator space for start-up businesses in the high tech sector. Barnsley’s new transport interchange sits next to the 3.81-hectare site being developed under the Barnsley Town Centre Regeneration Project. Completed in 2007, the redeveloped Barnsley Interchange combines the town’s main rail and bus stations and handles about 4.5 million passengers each year. New office and residential development in the town centre will also complement the town’s latest regeneration effort.

Other town centre investments in recent years include a new building for Barnsley College, which opened in September 2011. There has also been a £16 million investment on a 1,000-place sixth form college, which will accommodate the town’s growing student population. The college was built on the site of Barnsley former central library, which was demolished as part of the first phase of the town centre’s revamp. Improvements to the public realm in the town centre included Experience Barnsley, a project of the Barnsley People’s Museum and Archives Centre. The cultural and discovery centre at the old town hall boasts new museum galleries that attract approximately 250,000 visitors each year.

The latest phase of the Barnsley Town Centre Regeneration Project will involve the demolition and improvement of several buildings in the town centre by 2017. Demolition work started in late 2015 and construction of new leisure and retail facilities will begin in 2017. Construction is expected to continue into 2019.

Once complete, the site will feature a new landscaped public square that will link with main routes into the town centre. The square will be able to accommodate market stalls and events. It will also face the town’s indoor market, which will be refurbished as part of the project. Updates to the Metropolitan Centre and Market Hall are expected to be complete by 2017. The market will also be extended and the hope is to create an airy space that is integrated with the exterior square. A new shopping boulevard that will extend Lambra Road will also be ready by 2017, adding new commercial and leisure opportunities in the town centre. A new state-of-the-art central library on Mayday Green and additional car parking are also part of the regeneration project.

The site is being designed by the IBI Group, which was selected following a public tendering process. The international architecture and engineering firm’s Better Barnsley vision has already been recognised with the prestigious National Urban Design Award in 2016. For the management of the project, Turner & Townsend and Queensberry Real Estate were selected by the Barnsley Council.

Sources:

https://www.gov.uk/government/publications/regeneration-project-barnsley-town-centre-barnsley-gdv-100m/regeneration-project-barnsley-town-centre

Soon after the EU referendum vote, the Irish capital began making headlines as eyes turned westwards and Dublin emerged as a potential prime destination for companies considering relocating their London offices elsewhere in the EU. In fact, Dublin is already home to some large corporates in many high-value sectors, such as Citibank, Bank of America, JP Morgan, Google, LinkedIn, and Facebook.

Soon after the EU referendum vote, the Irish capital began making headlines as eyes turned westwards and Dublin emerged as a potential prime destination for companies considering relocating their London offices elsewhere in the EU. In fact, Dublin is already home to some large corporates in many high-value sectors, such as Citibank, Bank of America, JP Morgan, Google, LinkedIn, and Facebook. During 2016, the UK’s office market experienced a few ups and downs linked to political uncertainty and decreased consumer and investor confidence. In spite of this, the overall market performance did not stray far from what was expected: strong levels of leasing activity in the Big 6 office markets (namely Birmingham, Bristol, Edinburgh, Glasgow, Leeds and Manchester), sustained rental growth due to the limited availability of Grade A space in cities like Birmingham, Bristol, Leeds, Manchester, London, Cardiff, Edinburgh, and Glasgow, and a notable surge in the number of lettings closed in London towards the end of the year. Are these trends expected to continue during 2017?

During 2016, the UK’s office market experienced a few ups and downs linked to political uncertainty and decreased consumer and investor confidence. In spite of this, the overall market performance did not stray far from what was expected: strong levels of leasing activity in the Big 6 office markets (namely Birmingham, Bristol, Edinburgh, Glasgow, Leeds and Manchester), sustained rental growth due to the limited availability of Grade A space in cities like Birmingham, Bristol, Leeds, Manchester, London, Cardiff, Edinburgh, and Glasgow, and a notable surge in the number of lettings closed in London towards the end of the year. Are these trends expected to continue during 2017? The Titanic Quarter involves a master plan that will see the development of 185 acres of waterfront land in Belfast over the next three decades. With planning permission in place for some four million square feet, the development project will see new spaces for work and living emerge in coming years. In addition to developing a Media Campus and extending the Financial Services Campus, the site will see new leisure and tourism projects that will draw residents and visitors to the city.

The Titanic Quarter involves a master plan that will see the development of 185 acres of waterfront land in Belfast over the next three decades. With planning permission in place for some four million square feet, the development project will see new spaces for work and living emerge in coming years. In addition to developing a Media Campus and extending the Financial Services Campus, the site will see new leisure and tourism projects that will draw residents and visitors to the city. Preparing for Christmas entails a lot of planning to ensure offices are not short-staffed or important documents delayed because of the holiday. The season is a busy time of the year, when businesses experience changes to their own operations, from upticks in activity to significant slowdowns due to clients and others taking time off to enjoy the holiday.

Preparing for Christmas entails a lot of planning to ensure offices are not short-staffed or important documents delayed because of the holiday. The season is a busy time of the year, when businesses experience changes to their own operations, from upticks in activity to significant slowdowns due to clients and others taking time off to enjoy the holiday.

Barnsley was once an industrial town with thriving coal mining and glassmaking industries. The South Yorkshire town is now at the centre of regeneration efforts. In 2002, Barnsley Metropolitan Borough Council launched a regeneration programme designed to revitalise the town centre with an improved transport interchange, a new digital media centre,

Barnsley was once an industrial town with thriving coal mining and glassmaking industries. The South Yorkshire town is now at the centre of regeneration efforts. In 2002, Barnsley Metropolitan Borough Council launched a regeneration programme designed to revitalise the town centre with an improved transport interchange, a new digital media centre,  The Midlands in the heart of the UK represents an important economic region for future growth. From 2011 to 2015, there were 880 foreign direct investment projects in the region alone. This represents a quarter of foreign direct investment into the UK according to the Regeneration Investment Organisation (RIO), which is part of UK Trade & Investment (UKTI). International companies are investing in the Midlands thanks to excellent transport links that include three international airports (East Midlands, Birmingham and Luton). There are also no less than 27 universities in the region that offer businesses a strong talent pool and resources.

The Midlands in the heart of the UK represents an important economic region for future growth. From 2011 to 2015, there were 880 foreign direct investment projects in the region alone. This represents a quarter of foreign direct investment into the UK according to the Regeneration Investment Organisation (RIO), which is part of UK Trade & Investment (UKTI). International companies are investing in the Midlands thanks to excellent transport links that include three international airports (East Midlands, Birmingham and Luton). There are also no less than 27 universities in the region that offer businesses a strong talent pool and resources. In February 2016, the Health and Safety Executive announced that a series of changes had been made to health and safety law in the workplace. The new rules are mainly directed at business owners who fail to enforce the applicable health and safety standards in the workplace, and therefore have the objective of ensuring compliance across the board. In this post we take a look at the ins and outs of the new rules and at how business owners can ensure they comply with them and avoid penalties.

In February 2016, the Health and Safety Executive announced that a series of changes had been made to health and safety law in the workplace. The new rules are mainly directed at business owners who fail to enforce the applicable health and safety standards in the workplace, and therefore have the objective of ensuring compliance across the board. In this post we take a look at the ins and outs of the new rules and at how business owners can ensure they comply with them and avoid penalties. 2016 is set to bring about important changes in workplaces around the world. This article summarises the most important trends expected to be implemented across the workplace.

2016 is set to bring about important changes in workplaces around the world. This article summarises the most important trends expected to be implemented across the workplace.