In late 2014, real estate analysts anticipated that the UK office market would deliver a healthy performance during the 12 months that were to follow. In line with their predictions, steady recovery was the predominant theme across many European office property markets, and London remained at the top of the best-performing cities list, along with Stockholm, Dublin, Madrid, and Barcelona. The British office market is now heading into 2016 with confidence amid a generally positive economic climate. This article provides a summary of the performance of UK office market during 2015, a forecast of the key trends for 2016, and a review of how key UK market indicators fare in comparison with other global markets.

Key Office Market Trends for 2015 across the UK

-

Demand across the British office market has remained robust, especially in

established sub-markets like London

-

, Bristol, Reading, Sheffield,

Manchester

-

, and Liverpool. This stands in contrast with other European markets, which have experienced a slow down with regards to occupier demand over the past 12 months.

An increasing shortage of prime office space in core sub-markets, which is expected to continue as forecasts for the 2014-2016 period predict that new supply is only expected to account for 2.5% of the UK’s total office stock.

Linked to the above, 2015 saw a significant amount of overseas capital pouring into office markets other than London. Limited supply has spurred a growing interest in both prime regional and secondary markets like Newcastle, Nottingham, and Cardiff.

Pre-lease agreements have made up for a significant amount of new development take-up rates. Similarly, during 2015 the UK office market experienced a rise in pre-let contracts, with more than 3 million square feet being secured under this type of agreement.

Strengthened occupier activity has been driving rental growth rates that averaged 2.2% nationwide. Rental growth rates were higher for Central London offices (3.4%) and for offices in the South East (2.1%).

The Main Things the UK Office Market Will Benefit From in 2016

-

According to the British Chambers of Commerce, during 2016 the UK’s output growth will reach 2.6%, a figure that is markedly higher than the global GDP projections for Western European countries, set at 1.75%. This is expected to have a positive impact on the UK office market at large.

Sectoral growth in the creative, media and tech fields is expected to keep putting upward pressure on rents and driving vacancy rates to new lows. In particular, the creative sector has become the country’s fastest-growing industry, and many companies involved in creative activities are looking to expand and move to new office premises. Moreover, the resurgence of the banking and financial sectors, along with increasing employment rates in these industries, are also likely to benefit the UK office market during the next 12 months.

By the end of 2016, rental growth rates are expected to be 4% higher than the past 10-year average. This will clearly benefit landlords and investors who have assets in core UK office markets.

- A positive consumer sentiment bolstered by low inflation rates and an above-average score in the latest Optimism Index are likely to encourage business investments and drive further growth across the strongest regional office markets.

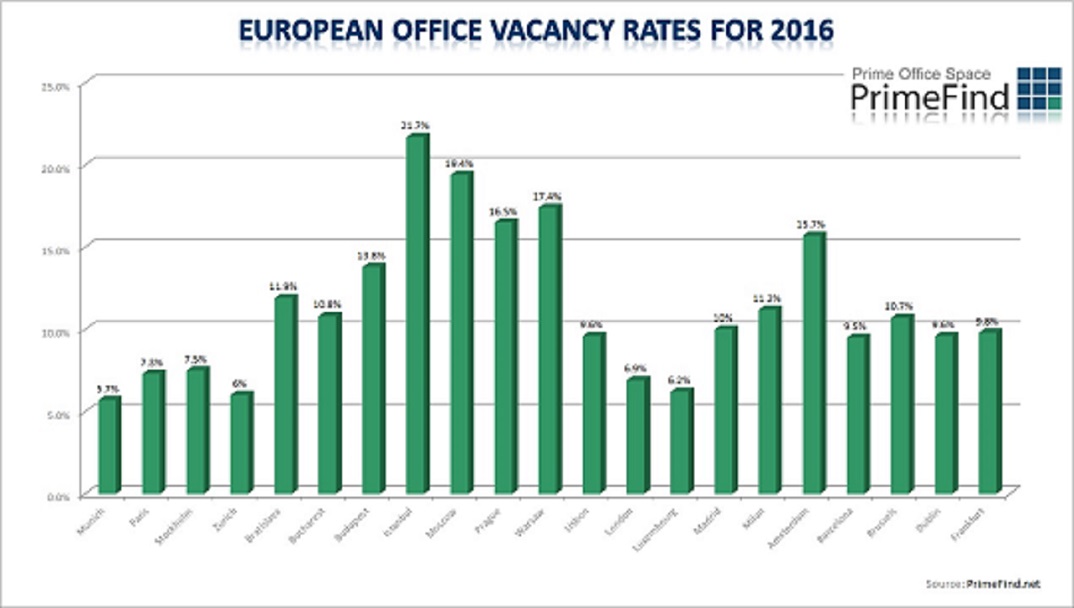

Office Vacancy Rates 2016

Office Vacancy Rates 2016

Western European Markets

Munich: remarkably low at 5.7%

Paris: 7.3%

Stockholm: declining vacancy rates that hover around 7.5%

Zurich: solid economic growth to drive rates down to 6%

Lisbon: stable at 9.6%

London: declining at 6.9% for offices in the City

Luxembourg: just above 6.2% and expected to decline further

Madrid: down to 10% thanks to a strengthened local economy

Milan: 11.2%

Amsterdam: decreasing to 15.7%

Barcelona: down to 9.5% following a modest improvement in economic indicators

Brussels: stable at 10.7% and marked by modest demand

Dublin: one of the strongest performers in the EU, with rates down to 9.6% from an all-time-high of 22% in 2010

Frankfurt: despite the deceleration in employment and export growth, rates remain low at 9.8%

Eastern European Markets

Bratislava: relatively unchanged at 11.9%

Bucharest: down to 10.8% and characterised by an overall positive performance and growing demand from the ICT sector

Budapest: 13.8%

Istanbul: slowly declining but still high at 21.7%

Moscow: a complex market under macroeconomic pressures that have brought the rates up to 19.4%

Prague: 16.5%

Warsaw: marked by oversupply with vacancy rates of 17.4%

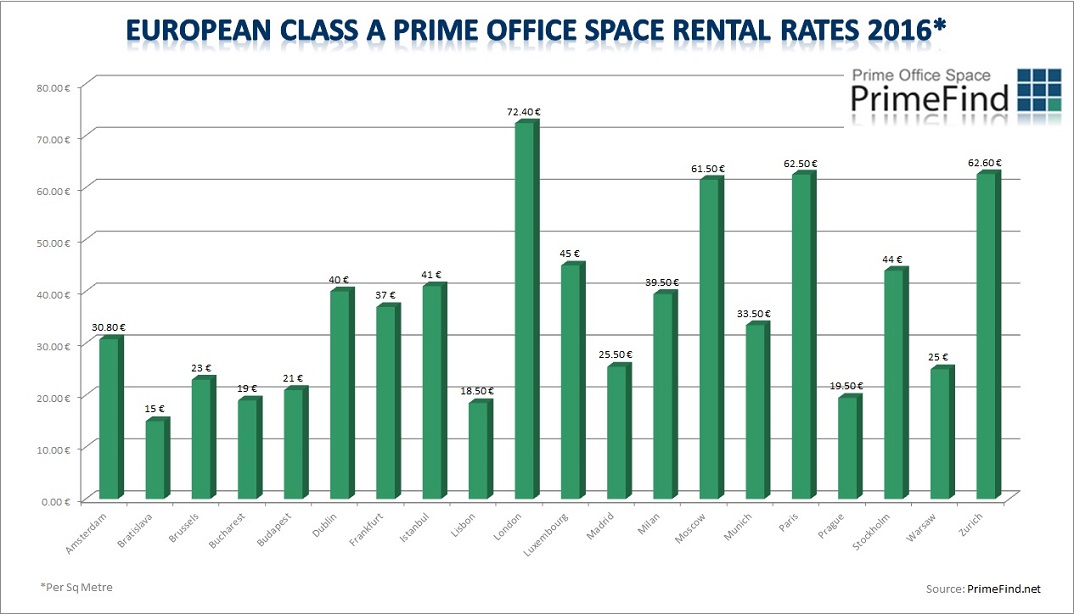

Class A Prime Rents 2016

Amsterdam: 30.80€ m2 / month

Bratislava: 15€ m2 / month

Brussels: stable at 23€ m2 / month

Bucharest: nearing 19€ m2 / month

Budapest: 21€ m2 / month

Dublin: 40€ m2 / month

Frankfurt: 37€ m2 / month

Istanbul: 41€ m2 / month (rates are capped by a substantial development pipeline of nearly 2 million square metres)

Lisbon: stable at 18.50€ m2 / month at least until end of the current year

London: 72.4€ m2 / month across the city, higher for “super-prime†rents in the West End (173€ m2 / month)

Luxembourg: approaching 45€ m2 / month

Madrid: edging towards 25.50€ m2 / month

Milan: just under 39.50€ m2 /month

Moscow: 61.50€ m2/ month (half of what they were in 2008)

Munich: 33.50€ m2 / month

Paris: 62.50€ m2 / month

Prague: unchanged at 19.50€ m2 / month

Stockholm: on the rise at 44€ m2 / month

Warsaw: unchanged at 25€ m2 / month and decreasing for the next 2 years

Zurich: 62.6€ m2 / month

Sources:

http://www.cushmanwakefield.co.uk/en/research-and-insight/2015/european-office-forecast-2015-2017/

http://www.cushmanwakefield.com/~/media/global-reports/Global%20Office%20Forecast_2015-2016-1205.pdf

http://www.savills.co.uk/research_articles/173552/197654-0

http://www.financialdirector.co.uk/financial-director/news/2441201/consumer-sentiment-protecting-uk-business-says-bdo

The Worcester Growth Corridor is a planned commercial and industrial development that will serve as a gateway for the city. Currently in early stages in development, the new economic corridor will focus on the manufacturing sector with the goal of supporting and attracting technology-rich manufacturing companies. The corridor will tap into local skills in information technology (IT), defence and cyber sectors. The development will also help position the city as a first rate Cathedral City, furthering Worcester’s role as a centre for business, commerce and shopping.

The Worcester Growth Corridor is a planned commercial and industrial development that will serve as a gateway for the city. Currently in early stages in development, the new economic corridor will focus on the manufacturing sector with the goal of supporting and attracting technology-rich manufacturing companies. The corridor will tap into local skills in information technology (IT), defence and cyber sectors. The development will also help position the city as a first rate Cathedral City, furthering Worcester’s role as a centre for business, commerce and shopping.

Office Vacancy Rates 2016

Office Vacancy Rates 2016 For employers all over the United Kingdom, the run up to Christmas is one of the busiest times of the year. Meeting tight deadlines, fulfilling large orders, launching seasonal promotions, and running the workplace while some staff are on leave are among the most common concerns for office-based employers. In addition, this is also a time to reward your team for their great performance and dedication, whether that means treating them to a nice office lunch or dinner or giving out Christmas bonuses or gifts. However, some of these actions may have tax repercussions. Here’s a quick guide to enjoying a (mostly) tax-free Christmas in your workplace.

For employers all over the United Kingdom, the run up to Christmas is one of the busiest times of the year. Meeting tight deadlines, fulfilling large orders, launching seasonal promotions, and running the workplace while some staff are on leave are among the most common concerns for office-based employers. In addition, this is also a time to reward your team for their great performance and dedication, whether that means treating them to a nice office lunch or dinner or giving out Christmas bonuses or gifts. However, some of these actions may have tax repercussions. Here’s a quick guide to enjoying a (mostly) tax-free Christmas in your workplace. According to an official report from the UK government, the Welsh economy has been growing at a fast pace since 2012 and has in fact overshadowed other UK regions in terms of job gains and GVA growth. However, several analysts have pointed out that economic growth rates in many areas of Wales still lag behind the national average. This is particularly true in rural areas that formerly relied on the primary sector as the main source of income, and at regional level the total GVA remains at 72 per cent of the UK average. Training programmes, job creation strategies, and important infrastructure improvements have been carried out over the past decade with the objective of making Wales an attractive business destination supported by a flourishing and strong economic base.

According to an official report from the UK government, the Welsh economy has been growing at a fast pace since 2012 and has in fact overshadowed other UK regions in terms of job gains and GVA growth. However, several analysts have pointed out that economic growth rates in many areas of Wales still lag behind the national average. This is particularly true in rural areas that formerly relied on the primary sector as the main source of income, and at regional level the total GVA remains at 72 per cent of the UK average. Training programmes, job creation strategies, and important infrastructure improvements have been carried out over the past decade with the objective of making Wales an attractive business destination supported by a flourishing and strong economic base. Nottingham’s MediPark will help boost the city of Nottingham’s position as a place for medical discoveries and support it as a designated Science City. The project will also help bring together life sciences and technology companies to create a new place to innovate.

Nottingham’s MediPark will help boost the city of Nottingham’s position as a place for medical discoveries and support it as a designated Science City. The project will also help bring together life sciences and technology companies to create a new place to innovate. The Impact of Office Environments on Employees

The Impact of Office Environments on Employees The city of Birmingham is the gateway to the Midlands and one of the best-ranking UK cities in terms of quality of life, entrepreneurship, and global outlook. Sustainable growth and innovation are key priorities for the local business community, as well as for the regional government, who is clearly aware of the city’s potential. Take a detailed look at the key facts and figures that make Birmingham one of the best cities for business in the United Kingdom.

The city of Birmingham is the gateway to the Midlands and one of the best-ranking UK cities in terms of quality of life, entrepreneurship, and global outlook. Sustainable growth and innovation are key priorities for the local business community, as well as for the regional government, who is clearly aware of the city’s potential. Take a detailed look at the key facts and figures that make Birmingham one of the best cities for business in the United Kingdom. Manchester has been an economic powerhouse since the early 19th century. Over the decades, the city has proved that it is open for business and that it can successfully rise to the challenges presented by increased global competition. As a result, this British city is considered one of the best European cities for business and startups in a wide variety of industries.

Manchester has been an economic powerhouse since the early 19th century. Over the decades, the city has proved that it is open for business and that it can successfully rise to the challenges presented by increased global competition. As a result, this British city is considered one of the best European cities for business and startups in a wide variety of industries.